The Importance Of Risk Assessment With Sei (SEI) And Trading Competitions

Importance of risk assessment using SEI competitions and commercial competitions in the cryptocurrency market

In recent years, the cryptocurrency world has grown exponentially, while millions of investors around the world are plunging to negotiate digital actives such as Bitcoins, Ethereum and others. However, as exciting as this market may be, it also comes at its own risk. One of the main aspects of the navigation of this high-risk environment is the assessment of the risk-process-process that helps investors make informed decisions about their investments.

What is the risk assessment?

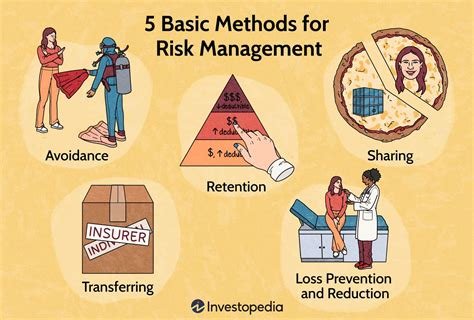

Risk assessment is a systematic assessment of possible losses or profits associated with an investment decision. Includes analysis of various factors, such as market trends, investor feelings and vulnerable security sites to determine the likelihood of success for a specific investment strategy. In the cryptocurrency market, risk assessment is particularly important due to inseparable volatility and unpredictability of these assets.

Ropela Sei (Institutional Investor Education Company)

SEI is an organization that provides educational sources and support services to institutional investors in the United States. One of its main initiatives is to help investors evaluate the risk of investment in cryptocurrency. By conducting research, market trends analysis and tool development to facilitate risk assessment, SEI focuses on the education and authorization of institutional investors on informed investment decisions.

Advantages of risk assessment using sei

Risk assessment can be a player player for investors, cryptocurrency trying to maximize their returns by minimizing their losses. Following the access of SEI, investors can:

1

Understanding Market Trends : SEI Risk Analysis Tools provide investors with market feeling, negotiating volume and other -chave indicators that help them make informed decisions.

- Identify Potential Risks : Investors can identify potential risks associated with cryptocurrencies, such as market volatility, regulatory changes, or vulnerable safety sites, allowing them to adapt their strategies to agreement.

- Develop a diverse portfolio : When evaluating the risk profile of individual assets in their portfolio, investors can create a more balanced and diverse investment portfolio that minimizes the issue of a specific asset.

- Investment performance improvement : If you are using a proactive risk assessment approach, investors can optimize their investment strategies to maximize returns and minimize losses.

Commercial competitions: key part of risk assessment

In addition to risk assessment through SEI, business competitions play an essential role in the encryption market. These events provide a platform for experienced traders and investors to test their skills against other participants and support the culture of competition and innovation.

Business competitions can help investors:

1.

- Popa to issue new strategies

: Competitions offer investors the opportunity to experience new business strategies that can help them adapt to their changes in market conditions and reduce exposure to specific risks.

3

Stay in the current state of industry development : Competitions usually include market data and real time analysis, informing informed investors about emerging trends and technologies that can affect the cryptocurrency market.

Conclusion

In conclusion, risk assessment is a critical part of navigation in the high -risk encryption market environment.